Employee salary tax calculator

The rates have gone up over time though the rate has been largely unchanged since 1992. Subtract 12900 for Married otherwise.

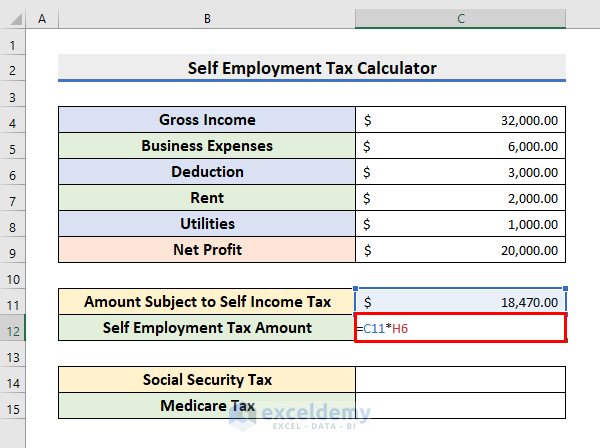

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

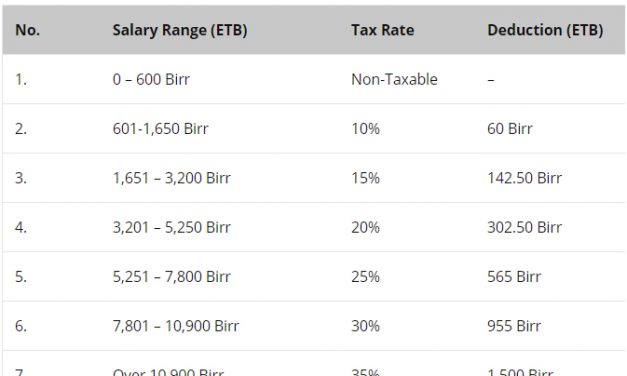

Employment Income Tax Calculator ወርሃዊ ደሞዝ Monthly Salary.

. As per the Federal Budget 2022-2023 presented by the Government of Pakistan the following slabs and income tax rates will be applicable for. The unadjusted results ignore the holidays and paid vacation days. Salary Paycheck and Payroll Calculator.

For example if an employee earns 1500. Your household income location filing status and number of personal. Social Security tax rate.

Components of Payroll Tax. Individuals can determine the total tax. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your. Generate your paystubs online in a few steps and have them emailed to you right away.

Calculating paychecks and need some help. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Payroll So Easy You Can Set It Up Run It Yourself.

It comprises the following components. Get Started Today with 2 Months Free. Ad In a few easy steps you can create your own paystubs and have them sent to your email.

The Tax Caculator Philipines 2022 is. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. It will confirm the deductions you include on your.

Our updated and free online salary tax calculator incorporates the changes announced in the Budget Speech. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The amount of HRA the employee receives can be claimed as a deduction either fully or partially from the taxable salary under section 1013A of the Income Tax Act 1961.

See how your refund take-home pay or tax due are affected by withholding amount. Use this tool to. Estimate your federal income tax withholding.

This component of the Payroll tax is withheld and forms a revenue source for the Federal. Federal Salary Paycheck Calculator. Income Tax Calculator - Individuals falling under the taxable income bracket are liable to pay a specific portion of their net annual income as tax.

2020 Federal income tax withholding calculation. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

How to calculate annual income. The standard FUTA tax rate is 6 so your. All Services Backed by Tax Guarantee.

For instance lets say youll earn 80000 which places you in. Get Your Quote Today with SurePayroll. Free Unbiased Reviews Top Picks.

If you earn a steady income estimate the tax youll owe for the year and send one-fourth to the IRS each quarter. Salary Income Tax Slabs 2022 - 2023. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. ETB Pension contribution Proclamation no7152011 - Private Employee The contribution is 11 by the employer and.

View what your tax saving or liability will be in the 20222023 tax year. How It Works. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Plug in the amount of money youd like to take home. Federal payroll tax rates for 2022 are. Related Take Home Pay.

Ad Compare This Years Top 5 Free Payroll Software. Enter your info to see your take home pay.

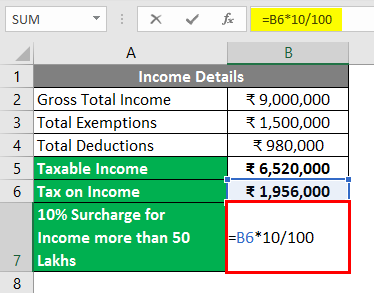

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

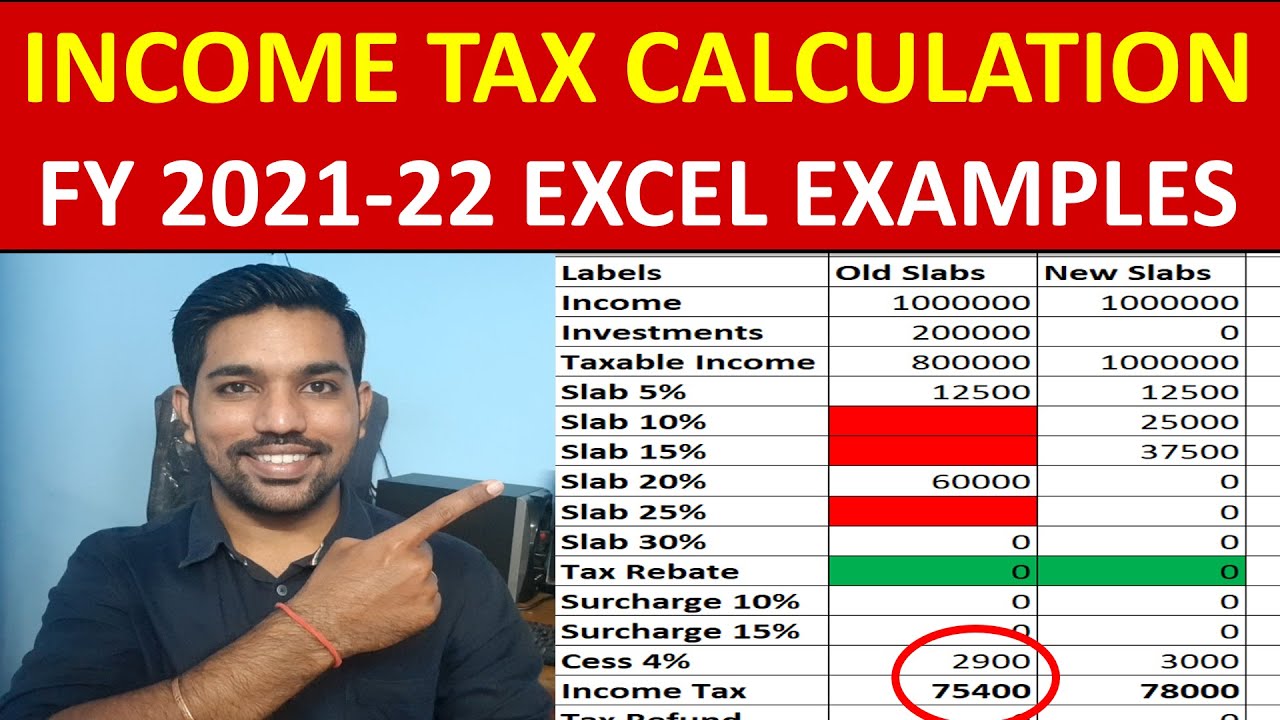

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

Sep 2022 Salary Pension Calculation In Ethiopia Latest Ethiopian News Addisbiz Com

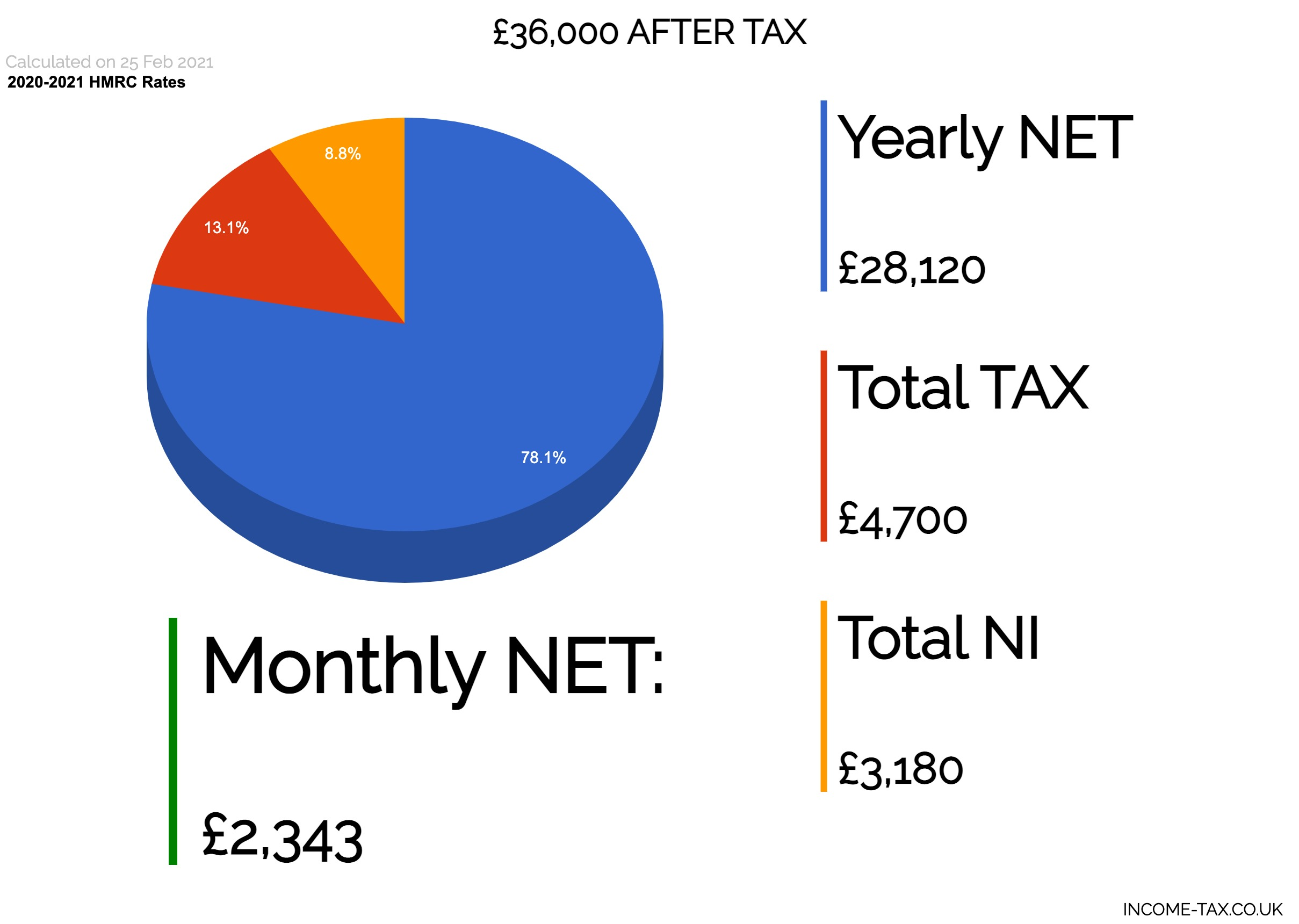

After Tax Uk Salary Tax Calculator

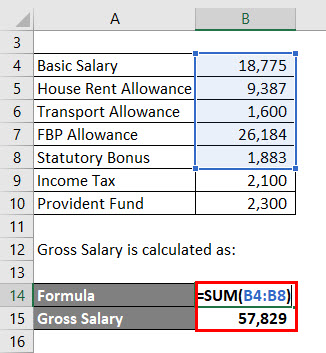

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax In Excel

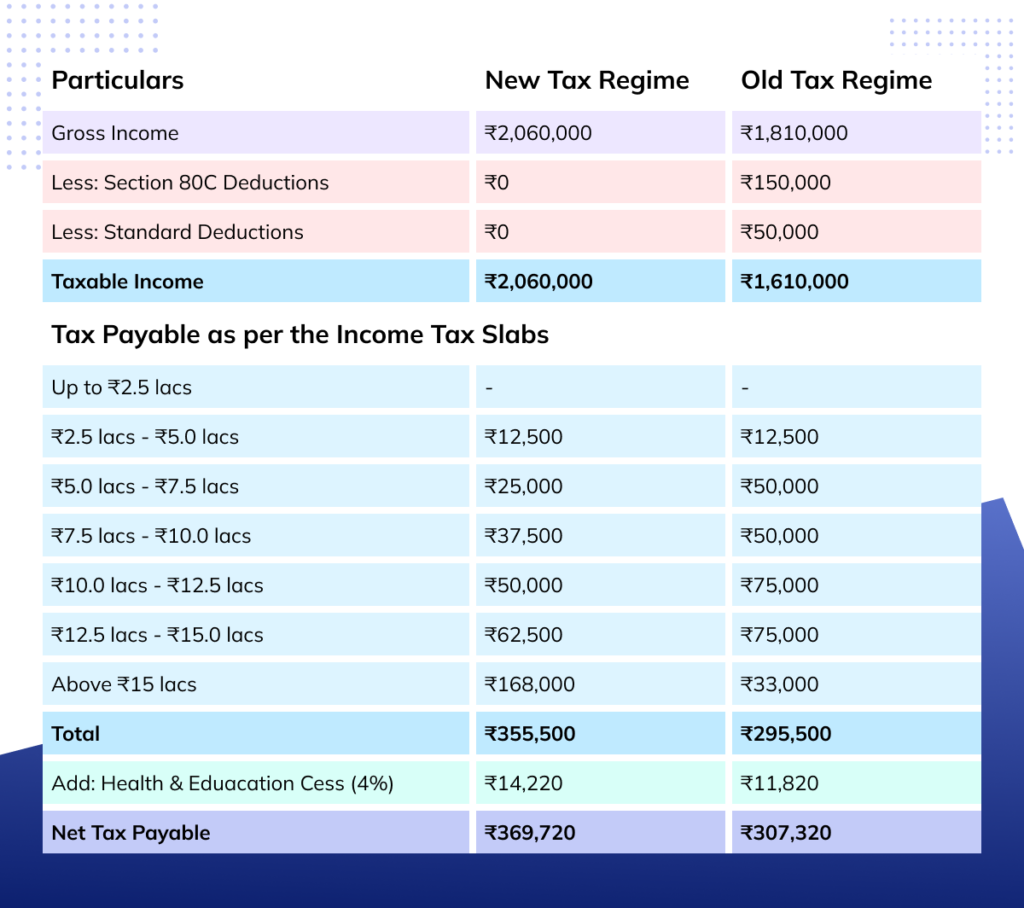

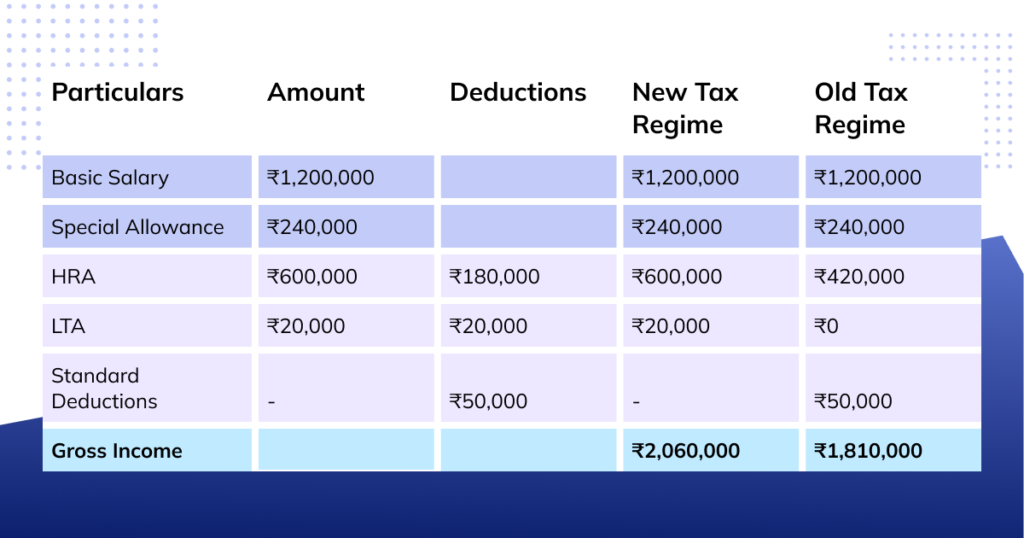

How To Calculate Income Tax On Salary With Example

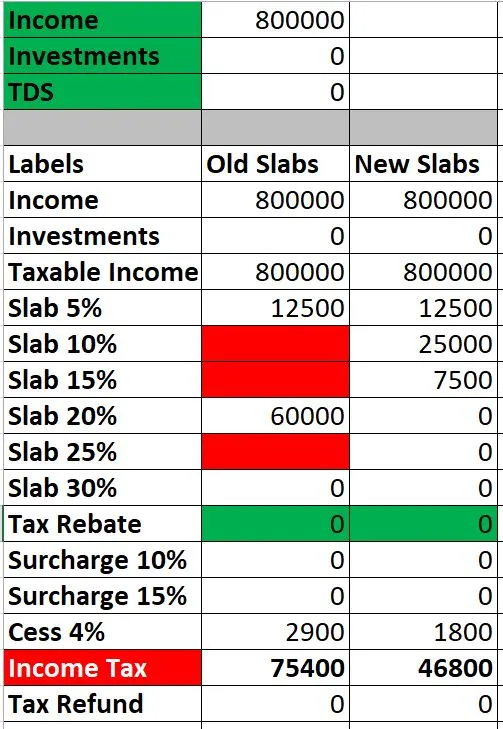

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

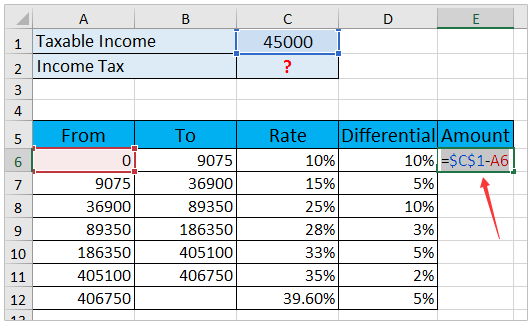

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Ethiopian Income Tax Calculator 10 0 3 Free Download

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax On Salary With Example

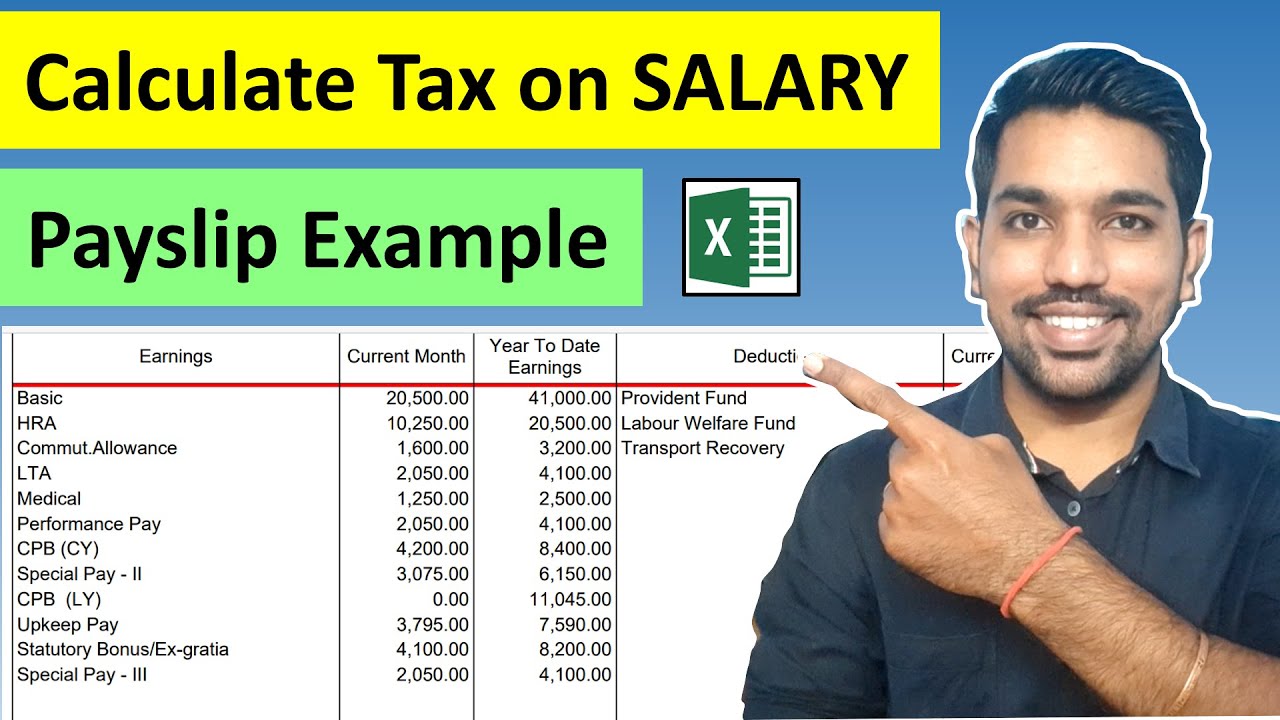

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Paycheck Calculator Take Home Pay Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube