Traditional 401k calculator

For example if you have a 25 income tax rate and contribute 1000 to your retirement. The first example uses a.

Roth Vs Traditional 401k Calculator Pensionmark

Traditional IRA depends on your income level and financial goals.

. Traditional 401 k Calculator. If your 401 or 403 retirement plan accepts both traditional and Roth contributions you have two ways to save for your retirement. Both offer federal income 401k INFO CLUB.

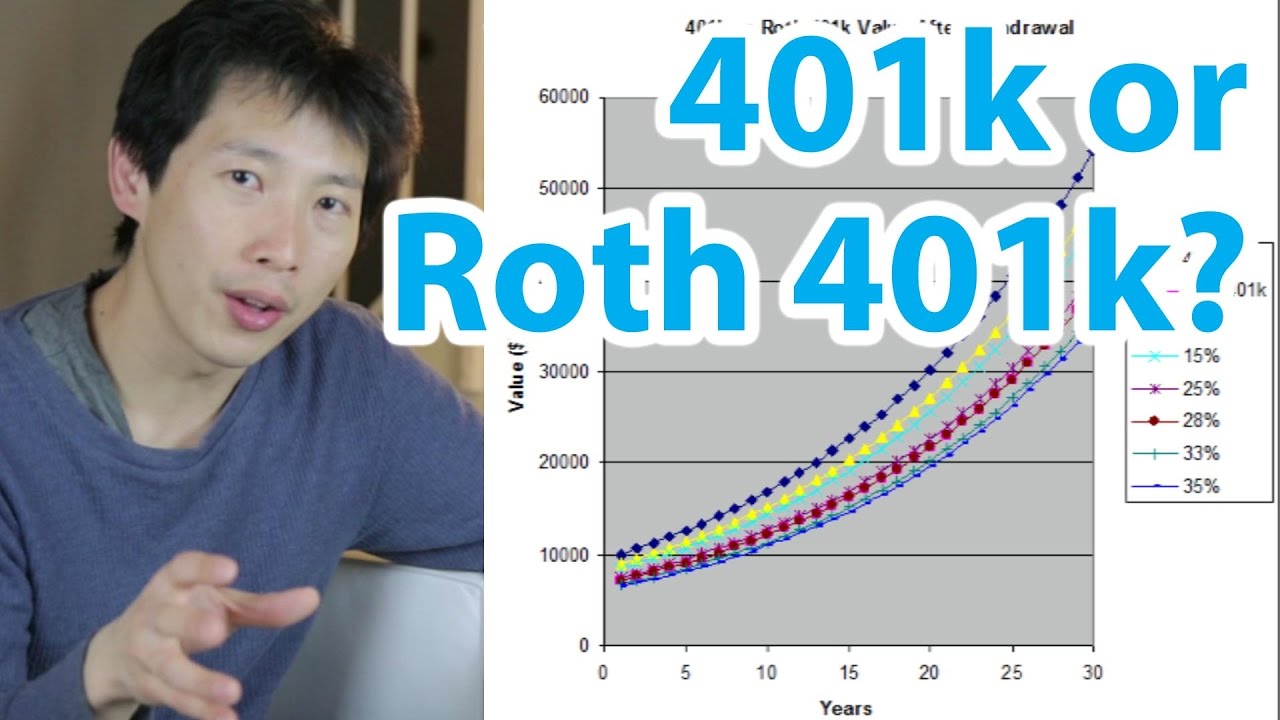

By changing any value in the following form fields calculated values are immediately provided for displayed output. For some investors this could prove to be a better option than the Traditional 401k contributions where deposits are made on a pre-tax basis but are subject to taxes when the money is. Roth 401k 403b 457b Calculator This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

NerdWallets 401k retirement calculator estimates what your 401k balance will be at retirement by factoring in your contributions employer matching dollars your expected. Contributions to a Traditional 401k plan are made on a pre-tax basis resulting in a lower tax bill and higher take home pay. By comparision Roth 401 k contributions are after-tax which means that you do not receive this tax break during your working years.

Roth 401 k vs. Forbes Advisors 401k calculator can help you understand how much you can save factoring in your expected age of retirement total contributions employers matching. This is the percentage of your salary that you plan to contribute to your 401k.

Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Heres how it works. Choosing between a Roth vs.

Contributions made to a Roth 401k are made on an after-tax basis. Traditional IRA Calculator can help you decide. Contribution of salary.

The Roth 401 k allows you to contribute to your 401 k account on an after. By investing your tax savings each year you equalize the total cash flow between the two account types. Here are three examples that display the tax differences for someone making 50000 and contributing to a Roth 401 k and a Traditional 401 k.

Note that our calculator allows increments of 1 and doesnt apply the IRSs. When you invest 500 and earn a 10 annual return your balance. Traditional vs Roth Calculator.

Use this calculator to help determine the best option for your retirement. Traditional IRA calculator and other 401k calculators to help consumers determine the best option for retirement savings. A traditional 401 k could provide an additional 500 of.

A 401 k contribution can be an effective retirement tool. Compounding is when your investment returns earn you even more returns over time.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401 K Vs Roth 401 K Calculator Which One Should You Invest In The Kickass Entrepreneur

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Free 401k Calculator For Excel Calculate Your 401k Savings

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Roth 401k Might Make You Richer Millennial Money

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro